Welcome to BAI L&D Connect®

BAI exists to give financial services leaders the confidence to make smart business decisions, every day. We are passionate about our mission and believe that a strong financial services industry helps consumers, businesses, and communities thrive. BAI L&D Connect was designed to provide all of the resources you might need including:

April Announcements

An exciting update to the “My Dashboard” page in the BAI Learning Manager was just released, providing numerous benefits to users. Check out and share the student demo video below!

End-To-End Policy Solution

The BAI Policy Manager helps financial services organizations make informed decisions when creating, updating, communicating, and tracking their organizational policies and procedures. It provides:

- Industry-specific regulatory resources to help you make informed decisions when creating and updating your policies

- Easy setup to help you get up and running quickly

- Focused processes, so you’re ready for your next examination

- Powerful communication tools to build a culture of compliance

Industry-specific regulatory resources

BAI provides compliance professionals with industry-specific actionable content that helps them make informed decisions during the policy management process, including:

- Regulatory Alerts (CFPB changes, FDIC updates, NCUA rules, etc.)

- Policy Considerations

- Policy Templates

- Regulation Overviews

Help you get up and running quickly

Quick Setup and Easy Administration. The BAI Policy Manager is designed to provide for a quick setup and easy administration, saving your compliance professionals significant time. BAI’s solution includes:

- Bulk import of existing policy documents

- Industry-specific table of contents

- Bulk import of users

- A human resources information system (HRIS) data exchange

- Configurable and reusable workflows

- Single sign-on (SSO)

So you’re ready for your next examination

Timely Updates and Acknowledgements. In the financial services industry, updating policies on time and having those policies acknowledged in a timely manner are crucial. The BAI Policy Manager includes many features designed with this understanding. BAI’s solution includes:

- Compliance professional and manager dashboards

- Report subscriptions

- Reminder emails

- User dashboards

- Audit reports

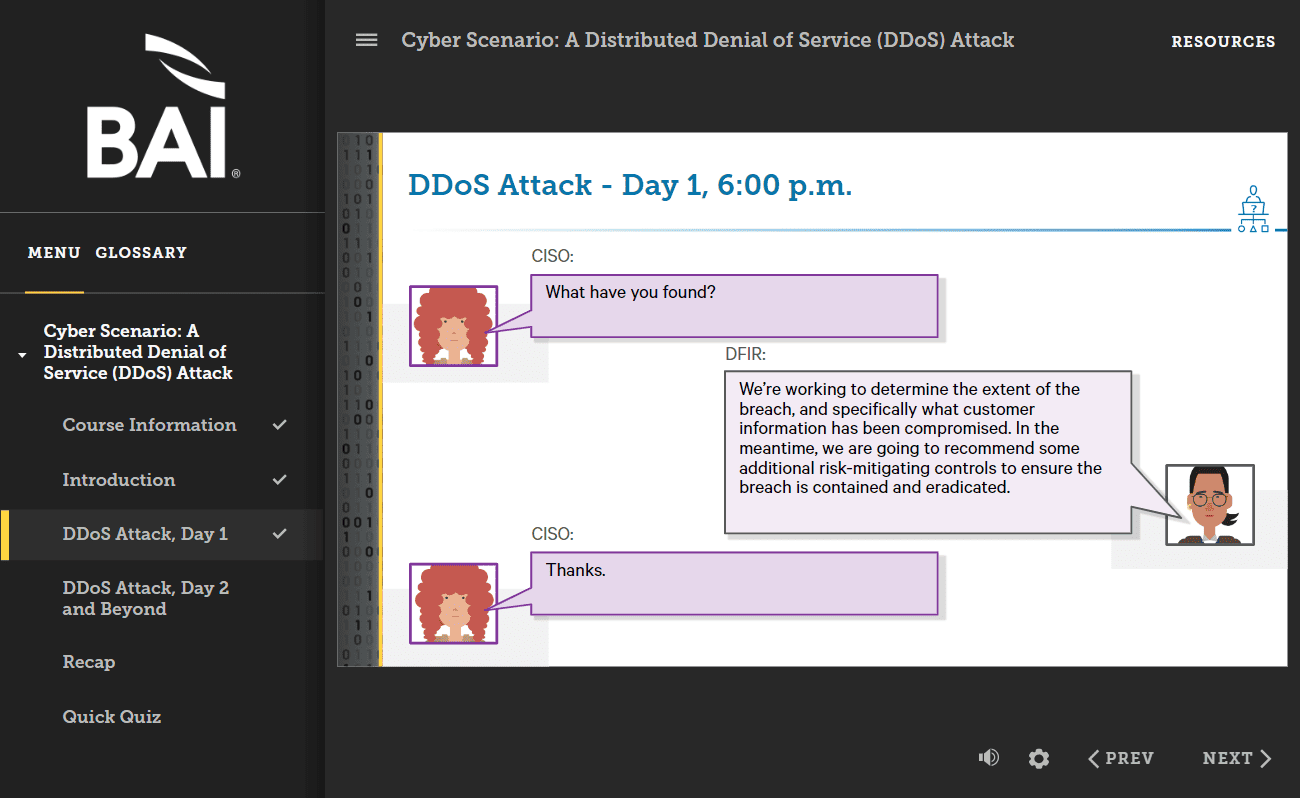

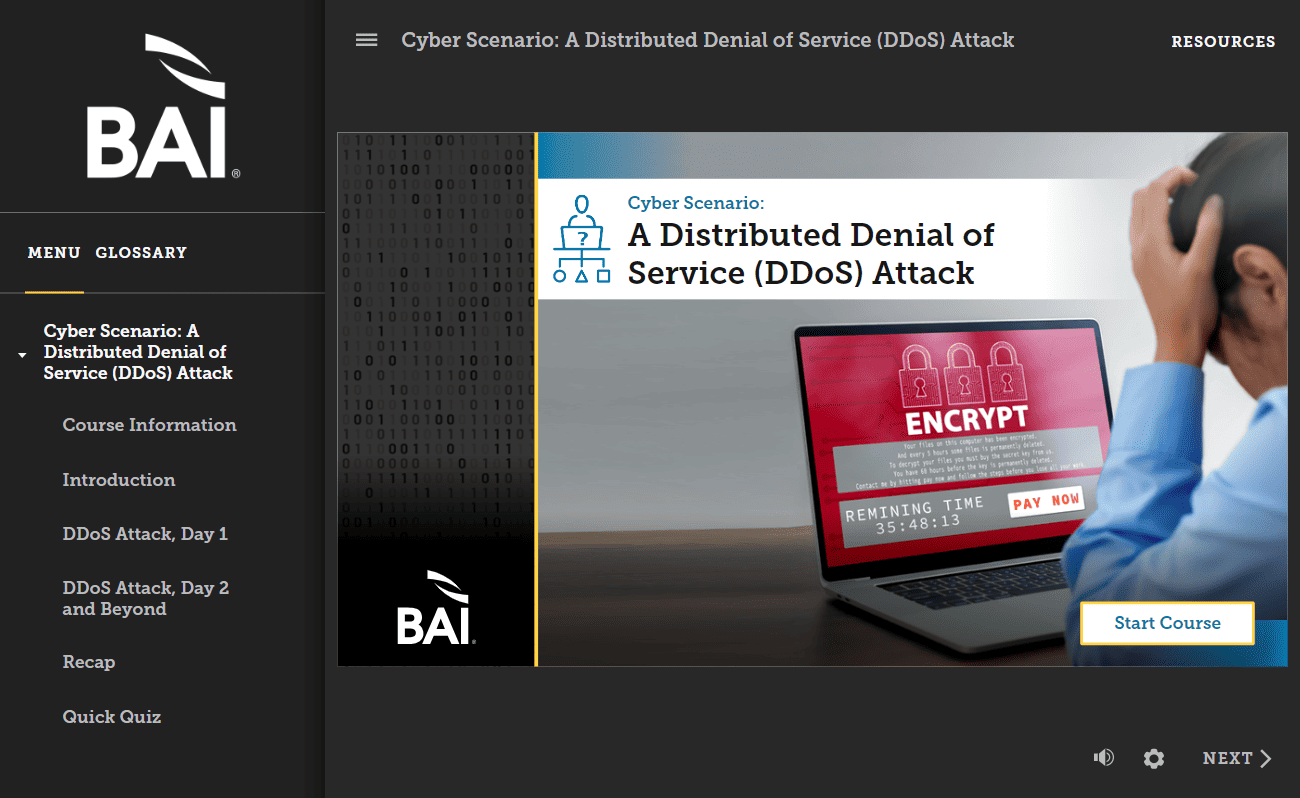

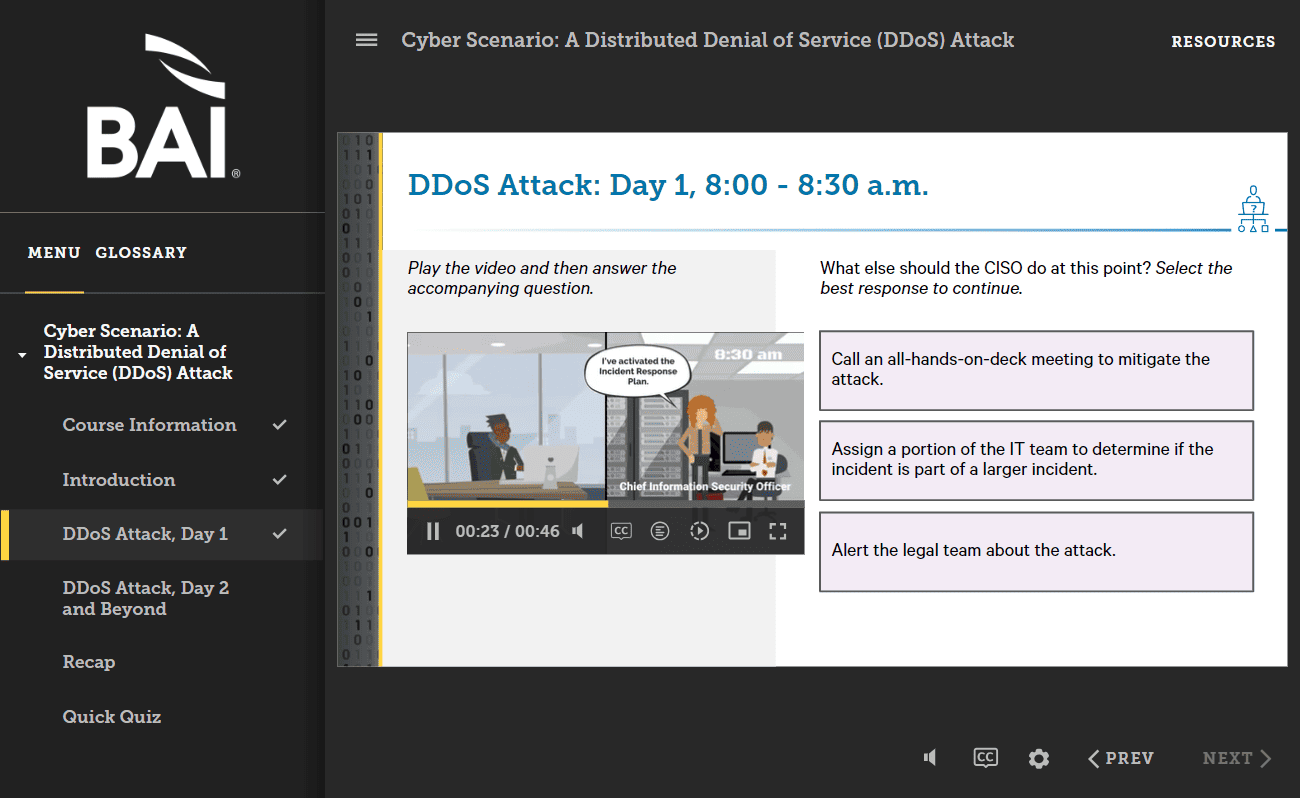

Cybersecurity remains a top-of-mind concern in the financial services industry. BAI is excited to be launching new Cyber Scenarios that address these risks and help organizations and their employees prevent and mitigate attacks. In these 10 to 15-minute story-based, interactive courses, learners face a relevant cybersecurity threat scenario in a financial institution and decide how they would proceed at key decision points.

90 Day Regulatory Outlook

Prepare for various pending regulatory changes

Published the beginning of each month, BAI’s 90-Day Regulatory Outlook helps you plan for the compliance landscape in the upcoming fiscal quarter. Receive insights from BAI’s compliance experts on which policies and training courses of yours will be impacted by the most recent and relevant regulatory changes.

Regulatory Alerts

Keep track of all regulatory changes, regardless of stage

Receive the latest Financial Services industry compliance news every week, including summaries of relevant announcements from more than 20 different regulatory bodies and overviews of personnel and products affected. Focusing on the changes that may impact your training and policy management programs our service covers various agencies.

Risk Alerts

Keep track of the latest risks, proposals, standards, resources and events your organization should know about

Risk Alerts provides the latest risk guidance, best practices, upcoming webinars, resources, and information related to organizations in the financial services industry. Receive weekly updates, with a summary of only the most relevant announcements from almost 30 organizations, including regulators, standard-setting agencies, and third-party experts.

.

Industry News

Biden Administration’s 2024 Regulatory Agenda

The below table contains a summary of some of the most significant agenda items for regulatory agencies that govern organizations in the financial services industry. Access to all the federal regulatory agenda items can be found here: Current Unified Agenda of Regulatory and Deregulatory Actions (reginfo.gov). Agency Topic Description Stage CFPB Fair Credit Reporting Act Rulemaking Key Objectives include change key defined terms, clarify permissible purpose, applicability of FCRA to data brokers and the sale of consumer data, prohibited marketing and advertising, processes to dispute accuracy, and to prohibit including consumer medical debt on consumer reports. Considering developing [...]

CRA Final Rule Key Elements You Should Know

The must anticipated Community Reinvestment Act (CRA) Interagency Final Rule was released on October 24, 2023. The release was the first time the rule had been revised in almost three decades. The final rule included a comprehensive overhaul of the requirements, including how banks will be evaluated. The Community Reinvestment Act (CRA) was created in 1977 and was designed to encourage banks to meet the credit needs of communities, with a strategic focus on low to moderate income communities. On April 1, 2024, the final rule and the public file requirements will be implemented. Banks have until January 1, 2026, [...]

Regulatory Status Check: What is Happening with Payments?

Payments is a financial service that is changing rapidly and generating significant regulatory interest. New technologies enable financial institutions to transform how retail and commercial customers make and receive payments. These innovations present sizable growth opportunities, while delivering better experiences and lowering costs. However, new payment capabilities also introduce risks that must be managed. In this case it is helpful to look at what both the CFPB and Federal Reserve are doing and how they might be related. The CFPB Sees Problems In September, the CFPB issued a report highlighting several concerns around new payments innovations including: Rapid growth of [...]

Resources from BAI.org

In the latest BAI Executive Report, we examine new customer acquisition, the leading issue identified in the 2023 BAI Banking Outlook survey.

Security experts weigh in on how banking institutions can keep customers safer without bogging down their mobile user experience.

To realize the full potential of their acquisition efforts, banks need an intense focus on customer engagement to build and sustain sticky relationships.

Ask an Expert

.

.

If you have any compliance questions or challenges, we have experts on hand to provide you with direct feedback. Please submit your questions to [email protected] and our experts will deliver compliance support straight to your inbox.

Click the button below to view answers to some frequently asked questions.